Any business that depends on its plant and equipment (P&E) assets could benefit from a valuation. This is key for managing insurance, financing, acquisitions and more. Plant & equipment valuers in Queensland review the likes of machinery, vehicles and property to determine their fair market value. This value is affected by a wide range of economic and market factors, as well as the type and condition of the P&E assets.

For this reason, valuation is an extensive process of research and analysis. Valuers look at various economic, industry-specific and asset-related factors. The information they uncover can be crucial for both business owners and investors. The final valuation report assists with decision-making, financial planning and future growth.

Considerations that affect P&E valuations include:

- interest, inflation and taxation rates

- economic growth

- government policies

- industry-specific incentives.

Each of these factors is known to fluctuate significantly. In turn, they can either positively or negatively affect the results of a valuation. Either can create opportunities and challenges.

When it comes to the physical assets; age, condition, maintenance records, functionality and obsolescence risk are key considerations.

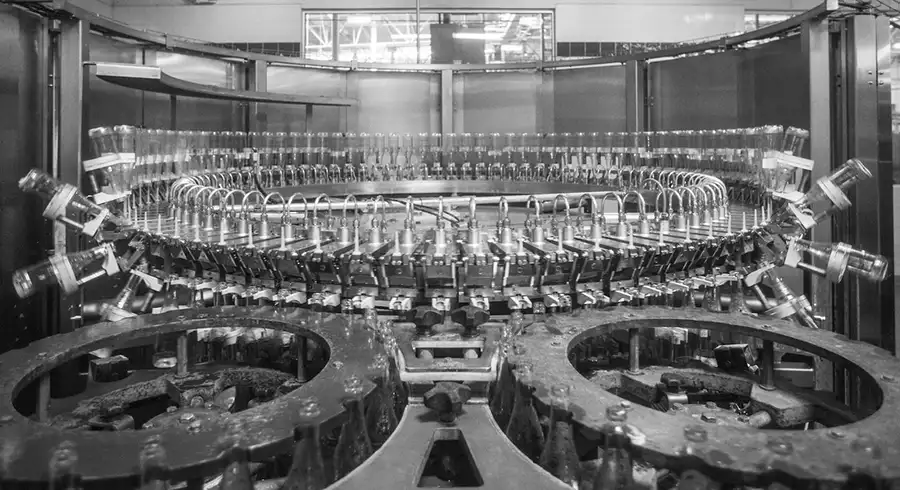

The industry the client operates in is important as well. This is particularly true across the manufacturing, construction and agriculture industries. Each is regularly affected by the likes of technological advancements, industry regulations, market demand and more.

What factors raise value in a P&E valuation?

Several factors may boost the value of assets in a plant and equipment valuation.

The age, condition, functionality and performance of the assets are paramount. Well-maintained or newer equipment, as well as equipment operating efficiently and to industry standards will always command a higher value.

Consistent, comprehensive and up-to-date maintenance records will provide evidence of appropriate upkeep and can positively impact the value of plant and equipment.

The market can notably influence value and so P&E valuers focus much of their research on this area. For example, if there is high demand and limited supply for certain types of equipment, their value tends to be higher. General economic conditions and industry trends can influence the value of your assets as well.

Valuers will review the general technological sophistication of the equipment too.

Assets incorporating advanced technology or innovative features and specialised capabilities generally hold a higher value. This is due to efficiency, productivity and cost savings.

These points must also be measured against various industry-specific considerations.

How do regulatory matters affect valuation?

The legal and regulatory environment notably affect asset value. For starters, P&E valuations must adhere to specific legal standards and regulations set forth by the Australian government.

These include those set out by:

- the Australian Accounting Standards

- the Corporations Act 2001.

Legal and regulatory frameworks also dictate the methods and rates used for depreciation calculations. These have a very direct influence on the value of plant and equipment.

Valuers will also need to remain abreast of all applicable tax laws and relevant updates.

A company’s P&E assets must comply with environmental regulations and determining risk is a key step in the valuation process. Applicable environmental standards include those for waste management practices, emissions control and other sustainable practices.

These assets must of course meet industry-specific safety regulations and standards as well.

Finally, valuers will need to check that businesses possess the requisite licenses or permits to operate legally. This minimises risk for both potential buyers and sellers.

Does the valuation’s purpose matter?

In most forms of valuation service, including those done for businesses and real estate, the actual purpose of the valuation is a valuer’s first consideration. This will affect the valuer’s approach to the process, but more importantly the result of the valuation.

If a valuation takes place for financial reporting purposes, valuers will focus on determining an asset’s replacement cost. This involves reviewing the age, condition and market availability of comparable assets.

For tax valuations, valuers must assess depreciated value for tax assessment and depreciation schedule purposes. If a business is simply looking to better manage its P&E assets, valuations can be used to inform decision-making regarding maintenance, repair and replacement strategies.

Services in support of sales and acquisitions will focus on negotiating a fair price.

In litigation matters, valuers may be used to provide expert opinions on the value of P&E assets in support of various proceedings.

Lastly, the valuation’s purpose impacts the choice of valuation methods and the level of detail required in the assessment. For example, the cost approach may be suitable for insurance valuations, while the income approach or market approach could be more applicable for valuations related to acquisitions or disposals.

Summary

The plant and equipment valuation process is influenced by a wide range of factors. As a result, so are the final determinations of the valuation. Asset owners and P&E valuers will need to review numerous physical, market, economic and industry factors to calculate an asset’s fair market value.

These include the age, condition and maintenance history of plant and equipment, as well as factors like supply and demand, interest and inflation rates and various legal and regulatory standards.

Clients can also expect higher valuations for specialised and technologically advanced assets.

Each valuation is fully tailored to the needs of the client and the purpose of the service. Valuations can be ordered for future planning purposes, buying and selling, mergers and acquisitions and more.

If you have questions about managing your P&E assets, call one of our licensed valuers today.